When it comes to correctly determining the real value of a business, investors, entrepreneurs and experts confront themselves with a critical question: What business valuation methods to use to obtain an accurate result?

Moreover, accuracy is complex and notoriously difficult when it comes to business valuation. Many factors are difficult to predict and assumptions that create such a wide range of valuations can bring the whole exercise of business valuation into question.

This article aims to help you understand the most common approaches and some supplementary less known methods used to establish the value of a company.

No matter if you are an investor looking for investment opportunities, an owner looking to sell your business, or a stakeholder in charge of strategy, these valuation methods will show you where the potential lies.

There is a trove of data out there that can help investors and consultants make more accurate predictions. For example, if analysed correctly, social media data can give us insights into industry and market trends, competitor analysis, intangible assets and the overall trajectory of an existing business, all of which can contribute to a more accurate valuation.

Check out how Symanto AI technology can help extract useful insights from your existing data to help with business valuation.

What Is a Business Valuation?

A business valuation or company valuation is a complex process that calculates the economic value of an entire organization or business line at a certain moment.

Most often assessing the value of a business involves using a variety of methods, and analysing a plethora of aspects like market conditions, industry trends, competition, the company’s financial statements, brand value, etc.

The idea is to determine an objective and fair value of the company, to offer an equidistant overview of its financial health and provide support for data-based informed strategic decisions.

Why is business valuation important?

Because it provides critical insights when making long-term strategic decisions that may affect dramatically the future of a company.

Common scenarios that use business valuation are:

- Merger and acquisitions

- Selling or buying a business

- Attracting capital and funds from external investors

- Expansion on other market segments or foreign markets

- Tax compliance and legal matters

What Are the Six Main Business Valuation Methods?

- Market-related valuation methods

- Comparable Company Analysis

- Prior Transaction Analysis

- Income-related valuation methods

- Discounted Cash Flow Analysis

- Capitalization of Earnings Method

- Asset-Related Business Valuation Methods

- Book Value Method

- Liquidation Value Method

Market-Related Valuation Methods

Market-related valuation methods, as the name suggests, are approaches that take into consideration real-world transactions and current market data to establish the economic worth of a company.

Comparable Company Analysis (CCA)

In essence, CCA is based on the comparison with similar companies active in the same industry. Somewhat similar businesses are taken into consideration in terms of size, risk profile, and growth perspectives.

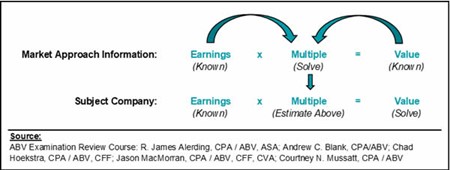

The evaluator will have to establish the value level based on market databases, set the transaction multiples obtained from earnings and do the multiplication to find out the business value.

Source: Marcum

The limitation of this method is the existence of data from comparable companies.

Another option is to determine the value of a business considering the multiples derived from companies listed on the stock exchanges (publicly traded).

But due to relevant differences between a private and public company, these multiples will be adjusted based on the estimated rate of return of the evaluated company.

Prior Transaction Analysis (PTA)

PTA involves determining the business value based on historical transactions of similar organisations.

Experts can estimate the market value considering these past transactions provided that they were realized in somewhat comparable circumstances. And that the current market conditions are not too different.

Income-Related Business Valuation Methods

Such methods assess a company’s worth bearing in mind the future forecasts of cash flow and income. And rely heavily on the future profitability of a company.

The most important such methods are:

Discounted Cash Flow Analysis (DCF)

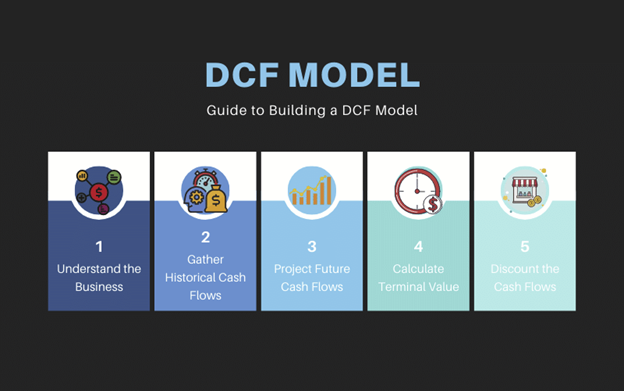

To determine the value of a business DCF analysis uses future projections of cash flow adjusted with inflation. Meaning it discounts the projected value with an adequate discount rate, that reflects the value of money in time and the risks that the organization incur.

The value of the company is established by summing up the discounted cash flows. It’s far more detailed than other methods, as it determines the intrinsic value of the business without the need to compare it to competitor companies.

DCF is a preferred business valuation method thanks to its capacity of including long-term potential and unique features. Since it gives a much clearer overview of the trajectory of a business, it is the preferred method of valuation for mergers and acquisitions.

But it is criticised because small differences in the cost of capital or forecasted growth rate can generate considerable differences in the final determined value. And for being too inward-looking and not paying due heed to competitor analysis and valuation.

Source: Training-NYC

Capitalization of Earnings Method

This method evaluates a business considering its future profits, calculated based on expected financial results and actual income.

The capitalization of earnings uses the following formula: net present value of future cash flows divided by the capitalization rate.

To assess a company’s value with accuracy using this method a comprehensive understanding of its business environment is essential.

Asset-Related Business Valuation Methods

Such methods use the net asset value of a business to calculate its value.

Book Value Method

Book Value is a method of business valuation that determines the value of a company based on its financial statements. The value is the total sum of assets minus the total sum of liabilities.

It’s considered a conservative way of assessing a business’s value emphasizing more the past costs than the current market value.

Even though this is a preferred method of valuation for prominent investors like Warren Buffet, it has its limitations, that are not to be neglected.

One major issue is that companies publish their report quarterly and yearly, thus the information is delayed in time and investors might find out too late about assets’ intentional depreciation, for example. Or asset valuation might be too high in some cases.

Liquidation Value Method

This is a method somewhat similar to the Book Value, the difference being that in this case, the business’s assets are evaluated under distressed conditions. Meaning sold at a discounted rate in comparison with the market value.

The Liquidation Value is calculated by subtracting the total liabilities from the value of the total assets obtained if sold today.

It’s particularly relevant for companies facing bankruptcy situations and looking to monetise their assets as quickly as possible.

As one can notice each of the above methods has its limitations and its strengths. If you are trying to identify which business valuation method is best or which business valuation method is the most accurate, most often you will conclude that you have to consider multiple methods or all that apply to your case.

To ensure you did your best to accurately assess your business value you can consider additional ways of uncovering powerful insights that support your strategic decisions.

Count on AI to Extract Actionable Insights for Business Valuation from Internal and External Databases

There is a tremendous amount of data out there for appraisers to use to improve the accuracy of their predictions and assumptions. For example, social media and review sites hold key insights into where a business sits in the market, what is its trajectory, and, more generally, it allows you to view industry trends. Or this is important information when conducting a business valuation.

However, the challenge for valuators has been finding and getting to grips with tools that can turn qualitative data into useful insights. This is exactly what the Symanto Insights Platform is designed to do.

Symanto’s deep learning AI technology draws statistics and quality insights directly from organic conversations online in review sites, on social media, surveys, in fact in any instance where you can capture qualitative data. Symanto tools give insights into factors of business valuation that are otherwise difficult to capture including:

- Intangible assets

For example, our clients use Symanto tools to evaluate brand equity. Brand recognition, brand loyalty and the likelihood that customers will recommend the brand all help to determine the future trajectory of the business. Is the business likely to grow exponentially? Or is customer acquisition and retention an ongoing challenge?

- Market trends

Symanto does more than identify buzzwords relating to your industry. It detects how people think and feel about topics through aspect-based sentiment. What are people talking about? What do customers increasingly value? Is there a growing interest in the services or products offered by the business, or has the sunset on that particular trend?

- Overall business trajectory

Brand sentiment can be measured over time to discover whether or not the business is on an upward trajectory.

- Competitor analysis

Find out how a brand compares to its main competitors both in general terms of brand sentiment and on specific topics and criteria. For example, one brand may be favoured for its value, while the other may be favoured for its wide product range.

Discovering a brand’s position and niche in the market not only assists with a brand valuation but also uncovers the potential for future growth.

- Due diligence reporting

Symanto can be used to support due diligence reporting for those conducting a business valuation as part of the due diligence process.

Get in touch and talk to our team about creating a personalised solution to help you and your consultant or assessor conduct a more thorough and accurate business valuation using existing data.

https://www.youtube.com/watch?v=dIlWJxo1pLA

Major Factors That Affect a Business’s Valuation

A series of critical factors influence the perceived value of a company at a certain moment. Understanding them properly allows you to have a better grasp of an organization’s financial situation and future growth perspectives.

Market conditions and industry circumstances

Companies operating in industries with solid growth potential are considered more valuable than those in declining industries. For example, an IT company is considered more valuable from this point of view than a company active in charcoal mining.

When assessing a company’s value elements like market trends, competition in their markets, or demand-supply variations have a solid impact.

Financial situation and performance

Useless to mention that a solid financial situation, with historically steady financial performance, is of the utmost interest among investors.

Constant income expansion, with a high profitability rate and consistent cash flow, are factors that will increase a company’s value.

Market position and competitive edge

Disposing of competitive advantages like a powerful brand, exclusivity contracts, registered trademarks, invention patents or proprietary technology bring higher valuations.

Also, market leader positions or high market share translate into superior valuations.

Competences and quality of the managing team

An experienced management team with high-level competencies is important for evaluators as it’s clear proof that the company under valuation has the odds to deliver the expected results in the future.

Respecting the best practices for corporate governance and transparently making decisions are positively reflected in a business valuation process.

Interest rates and economic cycle

The general economic conditions, the cycle of the economy, inflation rates, interest rates, and consumer confidence also influence the valuation of a business.

How to Select the Right Valuation Method?

Choosing the appropriate business valuation methods is paramount for assessing the real value of a company. That’s why it is recommended to take into consideration the following:

Use multiple valuation methods and compare the results obtained. If different valuation approaches deliver somewhat convergent results, the degree of accuracy increases. If discrepancies appear, supplementary analysis and methods are necessary.

For the best results, combine several valuation methods to obtain a holistic perspective on a company’s business. The main idea is to minimise the limitations of each method and improve the accuracy of the valuation.

Select a valuation method that fits the specificities of the industry and business type. For example, for a manufacturing business that has many tangible assets, asset-based valuation methods are the first on the list.

Usual Challenges That Appear When Performing a Business Valuation

Being a highly complex process, it’s inevitable to come across challenges and pitfalls.

Some of the most common are:

- Data availability, data reliability and pertinent data analysis. Insufficient data or incorrect data lead to inaccurate results in the valuation process. Not properly analysing all existing data can skip important insights that would have modified the final output of the valuation.

- Accuracy of future performance projections. Forecasting the future performance of a business is challenging by default and subject to interpretation, uncertainty and assumptions. To obtain a reliable forecast, it’s recommended to make realistic and/or conservative suppositions.

- Deal with bias and subjectivity. Valuation usually involves assumptions and subjective judgment, and different analysts may deliver very different valuations because of that. Employing multiple experts to execute valuations and standardizing procedures may minimize subjectivity.

- Results wrongly interpreted. Implies significant financial risks because of erroneous decisions. To avoid such a situation, it’s necessary to understand the overall context and the limitations of the valuation methods used.

Assessing the correct value of a business is difficult. To ensure the accuracy of the results obtained, you need to have in-depth knowledge of the business valuation methods, their limitations, and the factors that impact them. Plus, access to helpful tools and experts. Hopefully, you found some relevant clues in this article.