ESG reporting software is a technology that helps organisations measure and report their environmental, social, and governance (ESG) performance.

ESG reporting has gained importance in recent years as investors have become more interested in sustainable investing, and many countries have begun to require ESG reporting by law.

Given the complexity of ESG investigation and reporting, ESG reporting software can be invaluable for organisations and investors.

It can help organisations track their ESG performance over time, compare their ESG performance to peers, and identify opportunities for improvement.

ESG reporting software can also automate the ESG reporting process, making it easier and faster for companies to comply with reporting requirements.

For investors, ESG reporting applications can provide insights into which companies are managing ESG risks effectively, which are making commitments, and which companies may be exposed to ESG-related risks in the future.

Owing to the varying reasons why organisations and investors might use ESG reporting software, there is no one-size-fits-all solution. When choosing ESG reporting tools, it is essential to consider your organisation’s or investment firm’s specific needs.

This blog post will provide an overview of ESG reporting software and discuss some key considerations for companies when choosing the right tool for their needs.

What Is ESG Reporting?

ESG reporting is the process of measuring and disclosing an organisation’s environmental, social, and governance (ESG) performance.

ESG performance refers to an organisation’s impact on key ESG issues, such as climate change, human rights, bribery and corruption.

Why ESG Reporting Matters

ESG reporting is vital because it helps investors and other stakeholders understand an organisation’s ESG risks and opportunities.

What are ESG risks?

ESG risks are potential negative impacts that could result from an organisation’s activities on key ESG issues. For example, the risk of loss from climate-related damage to property or the risk of reputational damage from human rights violations.

What are ESG opportunities?

ESG opportunities, on the other hand, are potential positive impacts that could occur due to an organisation’s activities on key ESG issues. Such as the opportunity to reduce greenhouse gas emissions or the opportunity to improve employee engagement.

ESG Reporting: A Bonus, or a Necessity?

ESG reporting used to be voluntary. But it is becoming increasingly compulsory.

The European Union has adopted new rules requiring all companies listed on EU stock exchanges to disclose their ESG performance beginning in 2023.

Plus, in May 2022, the U.S. Securities and Exchange Commission proposed new rules requiring all companies to disclose their ESG performance.

ESG reporting is also becoming more critical to investors. A 2018 survey by Morgan Stanley found that 80% of asset owners considered ESG factors when making investment decisions.

A global 2020 survey by BlackRock found that more than half (54%) of global investors consider sustainable investing “fundamental to investment processes and outcomes.”

The Challenges of ESG Reporting

ESG reporting can be complex and time-consuming. Organisations need to collect data on a wide range of ESG indicators, which can be challenging to measure in a consistent and comparable way.

Moreover, ESG data sets are often changing and evolving, making tracking ESG performance difficult. Finally, ESG reporting is typically a recurring annual obligation for companies, which can add to the complexity and cost of ESG reporting.

How ESG Reporting Software Can Help Companies

ESG reporting software can help organisations

- gather and analyse ESG data,

- track their performance over time,

- compare their ESG performance to peers,

- identify opportunities for improvement.

Some ESG reporting software can also automate the ESG reporting process, making it easier and faster for companies to comply with ESG reporting requirements.

How ESG Reporting Software Can Help Investors

ESG reporting software can help investors screen companies for ESG risks and identify companies that are leaders in ESG performance.

It can also help investors track the ESG performance of their portfolios over time. And help corroborate sustainability claims made by organisations and weed out controversial companies before time is wasted on further investigation.

Tips to Choose the Right ESG Reporting Software for Your Business

There’s no one-size-fits-all solution to ESG reporting. The right tool for you depends on the size and complexity of your ESG program, the industry you are tracking or operating in, and your budget and resources.

So when choosing the right ESG reporting software for your needs, here are 10 points to consider:

1. Investor or organisation?

Investors and companies require different things from ESG reporting software.

If you’re a company, make sure the software you choose can help you meet the disclosure requirements of your investors and policymakers.

If you’re an investor, make sure the software you choose can help you screen companies for ESG risks, identify ESG leaders, and track whether companies are upholding their ESG commitments.

2. Self-managed or fully supported?

Do you want a self-managed solution or one fully supported by ESG experts? If you’re just starting ESG reporting, you may want a software solution offering more support. But if you have an ESG team in place, you may prefer a self-managed solution.

3. What languages does the software need to support?

You will need ESG reporting software that supports multiple languages if you operate across multiple geo-locations.

4. What industries does the software need to cover?

ESG reporting needs to vary by industry.

For example, companies in the oil and gas industry will need ESG reporting software that can track emissions data. Companies in the food and beverage industry will need ESG reporting software that can track water usage data.

Ensure the software you choose offers features specific to your industry.

5. What data sources does the software need to integrate with?

The ESG data you need will likely come from various sources, including financial, operational, and survey data. Make sure the software you choose can integrate all required data sources.

If necessary, confirm that the tool can accurately analyse unstructured data. For example, employee reviews, reports, and internal and external communications constitute valid ESG data but can be unstructured.

The ESG reporting software you choose should be able to accurately analyse this type of data and structured data.

6. Does the software offer ESG data collection?

In addition to analysing ESG data, some software solutions also offer ESG data collection services. This can be helpful if you don’t have an ESG team or need help collecting ESG data.

7. Does the platform provide benchmarking features?

Benchmarking in ESG is vital for understanding where your company stands in relation to its competitors and assessing what is considered “best practice” in ESG performance.

Some ESG reporting software solutions offer benchmarking features, which can help set ESG targets and measure progress over time.

8. Is the UI friendly?

The user interface (UI) of ESG reporting software can also vary widely. Some ESG reporting software offers a simple, straightforward UI that is easy to use. While others may offer more features and functionality at the expense of usability.

It’s also important to consider the transparency of your insights. Transparency is key when it comes to ESG reporting software. Make sure the platform you choose has a user-friendly interface that makes it easy for you to navigate ESG insights to trace the source of the data.

ESG reporting software should also make it easy for you to share ESG insights with stakeholders.

9. What is the software’s pricing model?

ESG reporting software can be priced in various ways, including subscription fees, pay-as-you-go fees, and one-time licensing fees. Be sure to consider the ESG reporting software’s pricing model before making a financial commitment.

10. Security Compliance

Ensure the ESG reporting software you choose has the necessary security features to protect your data and comply with all relevant regulations.

For example, GDPR in the EU, and SEC regulations in the US.

ESG reporting software should also offer features that allow you to control who has access to your ESG data and insights. For example, some ESG reporting software solutions offer role-based access control, which allows you to restrict access of specific users.

The above considerations are just some things you should remember when choosing ESG reporting software. Be sure to do your research and choose the ESG reporting software that best meets your needs.

Best ESG Reporting Software

Symanto uses a combination of NLP technology (functional on 100+ languages) and advanced data sourcing and analysing capabilities to help companies and investors get a quick and clear overview of ESG risks and opportunities based on various publicly available sources.

With an ESG scan from Symanto, investors can quickly rule out controversial companies before time is wasted on further investigation. Compare the performance of your target against its competitors, quickly identify ESG leaders and laggards, and stay on top of the latest ESG trends.

Companies can use Symanto’s ESG scan to benchmark their ESG performance against their peers and identify areas of improvement. By analysing social media, reports, articles, employee reviews and other public data, companies can get clear insights into their competitor’s commitments, strategies and performance.

Symanto’s features that are helpful for ESG:

- Gather data from an extensive palette of data sources. Collect data from over 75 online data sources, upload your own files, or from social channels.

- AI-powered technology. Our solution includes state-of-the-art AI technology.

- Personalised reporting. Organise the reports as per your business’s needs.

- Industry-specific. Use personalised models to tailor your research and report based on your industry’s specificities.

- Multilingual.

Among the prominent brands that choose to work with Symanto are Microsoft, Adidas, Abbot, Paramount, FC Bayern Munchen, Leica, UBL, etc.

Get in touch to learn more about how Symanto can help you with ESG reporting. Our mission is to empower data-based decision-making for a more sustainable future.

| Advantages | Disadvantages |

|---|---|

| Extensive connectivity of data sources | Slight learning curve |

| Personalised reporting | |

| Industry-specific | |

| Multilanguage | |

| AI-powered |

Workiva promises to help your business develop a sustainable strategy and “power transparent reporting for a better world”. And digitise your ESG planning processes, disclosures and materiality evaluations in order to keep pace with regulators’ requirements.

It’s a tool that supports organisations in making noticeable progress in reaching their ESG goals while being transparent about their practices.

Use a top solution to drive progress, ESG performance and, finally, profit. Take the most of one platform that delivers it all in terms of ESG, with a variety of reporting options, robust financial analysis, framework mapping and data-gathering capabilities.

Workiva’s most prominent features are

- ESG frameworks. The function ESG Explorer allows you to browse a selection of pre-made ESG standards and frameworks and choose the critical indicators for your business.

- Data collection. Interconnect data from a large variety of sources with context and clarity and in a controlled environment.

- Generative AI. Employ the power of AI for ESG teams, financial audit and reporting.

- Marketplace. Reduce the complexity of ESG work with connectors, templates, and specialised services from industry professionals. Examples of templates: SEC reporting checklist, board reporting template, ESG materiality assessment, rounding template, etc.

Workiva has a cluster of thousands of clients that includes prominent brands like JP Morgan, Cognizant, Baker Hughes, Exxaro, Iberdrola, Amgen, Aker Horizons, etc.

| Advantages | Disadvantages |

|---|---|

| Multiple sources for data collection | Steep learning curve |

| Generative AI | Real-time changes implemented by the user are not possible |

| ESG frameworks | |

| Marketplace for services | |

| User-friendly interface |

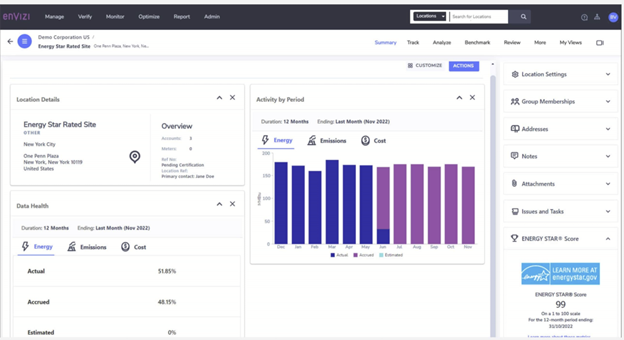

IBM Envizi is a cloud-based ESG technology that gathers, aggregates, classifies, analysis and documents your governance, societal and environmental data.

It integrates a selection of products that help businesses collect and manage all the ESG-related data under the same roof and confidently report, being aware that their data is finance-level and auditable.

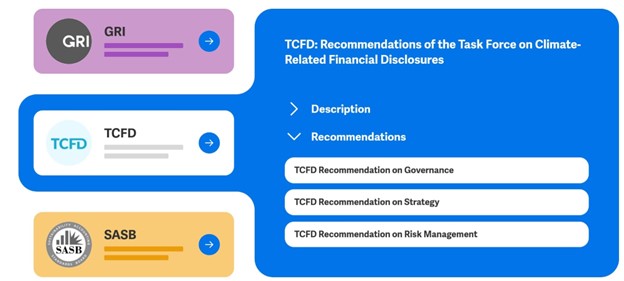

This solution enables companies to report based on external frameworks like ESRS, GRESB, GRI, SASB, UN SDGs, etc. As it consolidates inquiries from these frameworks into a single application.

The power behind such a technology is an engine that automates ESG data collection and traces performance in a certain period of time.

Here are some key characteristics of this ESG reporting suite:

- Collection of templates for compliance and management reporting.

- Advanced integrations with NABERS and ENERGY STAR to get ratings and scores.

- Updated guidance on framework standards to reach ESG reporting goals.

- Audit compatible as it incorporates capabilities that offer auditors access to a platform where data, trails and documents are presented together.

ESG task management with status and deadlines to keep accountability.

| Advantages | Disadvantages |

|---|---|

| Advanced integrations | No AI integration |

| Collection of templates and ESG framework standards | Complex initial deployment |

| Audit capabilities | May be pricey for medium businesses |

| ESG task management | |

| User-friendly interface |

Morningstar Sustainalytics aims to deliver top-level ESG research, analytics, ratings and data for environment conscious organisations and institutional investors.

Their declared mission is to “provide the insights required for investors and companies to make more informed decisions that lead to a more just and sustainable global economy.”

During the last three decades, Sustainalytics concentrated on crafting innovative solutions that allow institutional investors to determine, comprehend and manage ESG-related risks and opportunities.

Recently awarded as ESG Research Firm of the Year at the Global Capital’s EU Securitization Awards 2023, Sustainalytics developed new solutions dedicated to low carbon forecasts. Plus, they deliver detailed sustainability resources that help companies accommodate climate change and achieve Net Zero.

And tries to offer valuable ESG insights to a diverse typology of investors across all asset classes.

Sustainalytic’s remarkable features:

- ESG Licenses. Show the success of your ESG strategy by leveraging your ESG score and disclosing sustainability commitments.

- ESG Risk Ratings. Get a better understanding of ESG risks.

- Peer Performance Insights. Compare your ESG performance with the one of your main competitors.

Pre-IPO ESG Assessment. If you are preparing for an IPO, an ESG Assessment will highlight your commitment to sustainability in front of potential investors.

| Advantages | Disadvantages |

|---|---|

| ESG research and analytics | No AI integration |

| ESG scoring and risk ratings | Learning curve |

| ESG insights into the competitors' performance |

Greenomy was born from the desire to help businesses measure and improve their sustainability. It’s an AI-backed ESG reporting solution for EU Taxonomy, CSRD (Corporate Sustainability Reporting Directive), ISSB (International Sustainability Standards Board) and other standards.

They assist asset management companies, corporations and credit institutions to collect, analyse and share ESG data in a complex ecosystem. Plus, they facilitate collaboration and fund redirection towards green initiatives.

In a nutshell, Greenomy helps streamline your business’s sustainability reporting, providing the tools and capabilities to comprehend and comply with green regulations. And stay on top of future developments in this area.

Some valuable features your organisation might be interested in:

- Advisory services. Profit on personalised expert advice on how to get started with implementing sustainability standards that are relevant for your business, and create a reporting strategic plan.

- Academy and resources. You have at your disposal an extensive suite of resources to understand ESG regulations and easily comply.

- ESG data and integration services. Get expert help to define sustainability KPIs for your business to achieve regulatory compliance. And integrate cloud-based tools to save time, automate reporting and be audit-ready.

Greenomy is trusted by renowned brands like Roland Berger, Accenture, LSEG, Borsa Italiana, Deloitte, Beaulieu International Group, Temenos, Liege Airport, etc.

| Advantages | Disadvantages |

|---|---|

| ESG integrations | May be pricey for smaller organisations |

| ESG academy | Complex initial deployment |

| ESG advisory services |