Customer sentiment can tell you a lot. Measuring net sentiment can give you a quick pulse on how well a brand is doing, and sentiment by topic can help you pinpoint issues customers are struggling with (or raving about). But sentiment analysis is just the beginning when it comes to understanding what people think about a brand.

The same data you can use to measure sentiment on social media, review sites, etc. also contains useful insights into brand health – if you know where to look. And that’s valuable information to have during due diligence, whether you’re acting for a third party as a consultancy, planning to invest, or looking to advance your own business.

At Symanto, two of the services we offer are a Symanto due diligence report and a due diligence with brand health report. In this blog, we’ll explain and differentiate these two offerings so that you can see the value in both, and understand when it makes sense to go beyond sentiment analysis. As you will discover, surprising things can lurk beneath the surface.

What’s Included in a Symanto Due Diligence Report?

A Symanto due diligence report assists you in understanding the performance of a brand from the perspective of its customers to give you deeper insights and support your overall due diligence reporting. When you order a due diligence report from Symanto, you receive an analysis of online data related to the brand under review and its main competitors. This includes social media (Facebook, Twitter, Instagram, etc.), news, blogs, and forums. We also look at review sites such as Yelp, TripAdvisor, and Amazon.

Our due diligence report contains sentiment and engagement metrics, and breaks down sentiment by topic so that you can easily visualise each brand’s strengths and weaknesses from the perspective of the customers.

The Symanto due diligence analysis includes:

- Consumer topics. Understand what topics are resonating with consumers and the sentiment around those topics

- Sentiment tonality. Positive, negative, and neutral sentiments conveyed in text

- Functional drivers and barriers. Discover the tangible, basic elements of the consumer

experience that influence consumers’ quality perceptions of the brand - Consumer personality. Understand the consumer types (emotional & rational) and segments

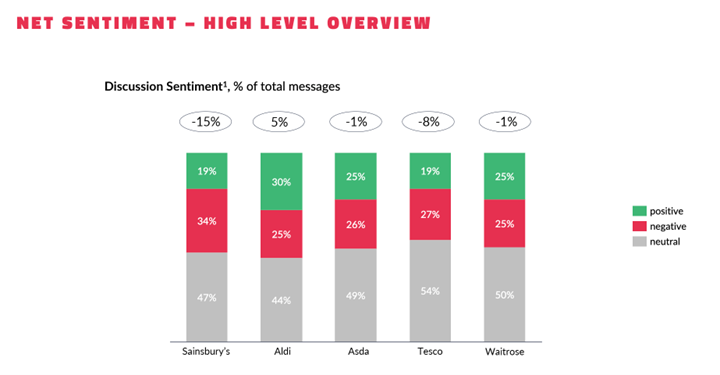

The following examples are taken from one of our due diligence reports comparing main UK supermarket chains. From these three slides, you can see how the due diligence report gives insight into consumer sentiment through different lenses so that you can explore the data at the desired level.

High-level overview

The high-level overview chart gives you a general understanding of overall brand performance. In the example below, you can see that Aldi has the highest net sentiment score at 5%, while Sainsbury’s is struggling at -15%.

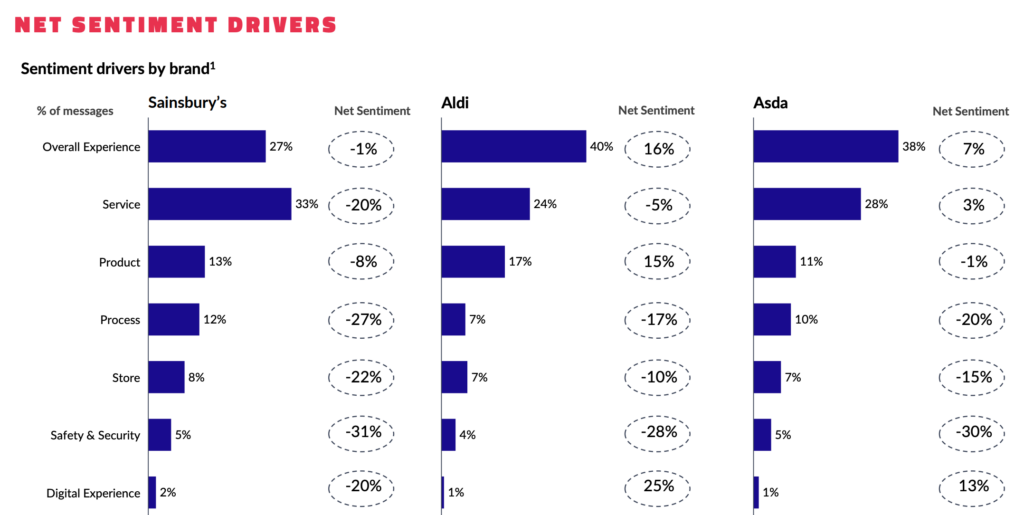

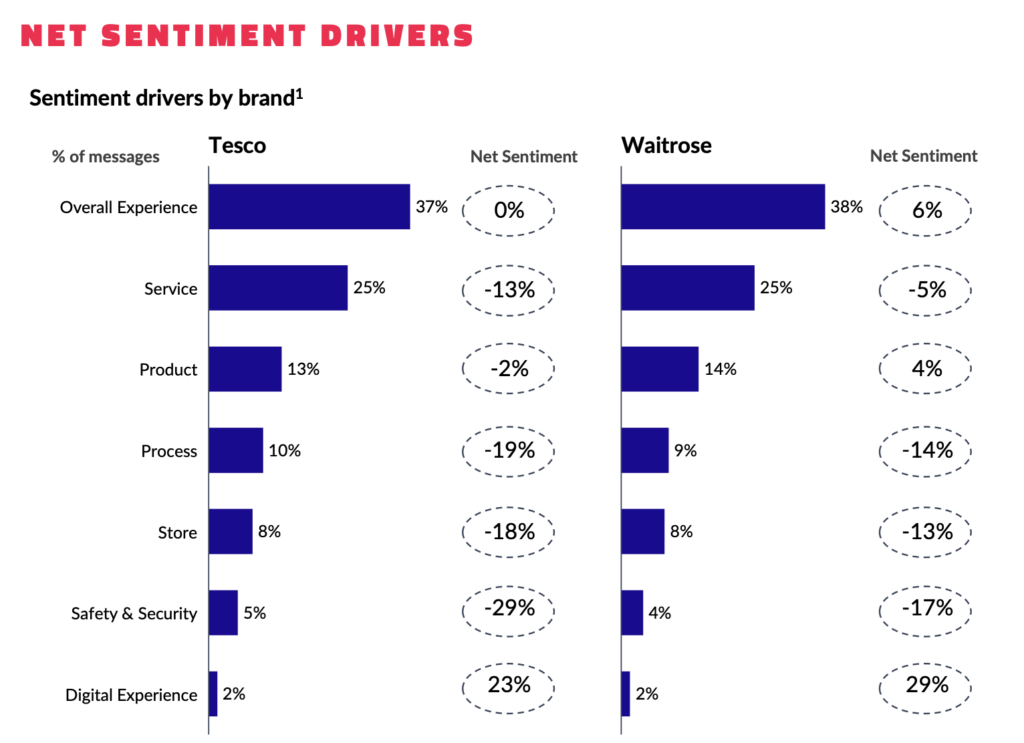

Drivers

The next slides look at the main topics driving sentiment. Comparing the brands together we can see that, across the board, customers are largely driven by the same topics. Service is the most important driver for Sainsbury’s customers, and yet, their net sentiment score for service is -20%, indicating that this is what most customers are unhappy about.

Meanwhile, the data on Aldi shows that products are comparatively more important to their customer base than other stores, and it’s here where Aldi excels.

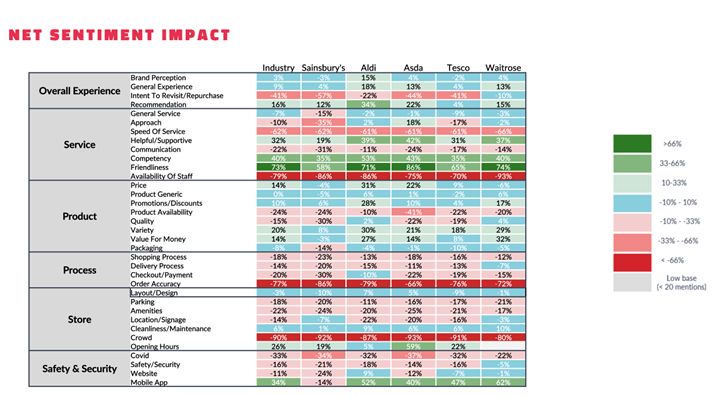

Impact

The third chart goes into yet further detail, breaking down topics into subtopics to get a more granular understanding of what customers are talking about. The colour-coded data visualisation makes it easy to compare performance between brands and identify the main strengths and weaknesses of each brand.

For example, we know that service is a key issue for Sainsbury’s, so let’s take a further look. On face value, it would appear that speed of service and availability of staff are key issues, but looking across the board it seems that this is an issue affecting all of their competitors more or less equally. By comparing their performance with their competitors, we can identify that other issues, such as approach and helpfulness are more pressing issues.

As you can see, sentiment is a valuable metric for due diligence analysis. It can give you a quick overview of how a brand is performing as well as detailed insights into what’s driving that performance. But, it’s possible to go even further and get insights into the emotional connectedness of a brand’s customer base. This is where our due diligence with brand health report comes in.

What’s Included in a Due Diligence with Brand Health Report?

The Symanto due diligence with brand health report includes everything from our standard due diligence report and much more, producing some interesting and actionable insights that can guide your strategy. The due diligence with brand health report goes beyond simple sentiment analysis to give you a deeper understanding of how emotionally attached your customers are to the target brand. It also shows growth potential and optimisation opportunities based on a thorough understanding of brand health.

Here are some of the additional analyses included in a Symanto due diligence with brand health report with examples from our UK supermarket report.

Year-on-year growth

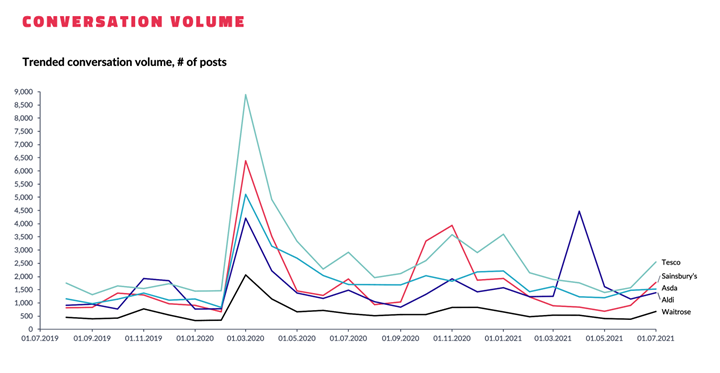

Our brand health report analyses key metrics over time and across competitors. Discover which platforms are driving brand awareness in your industry, and whether the target brand is well represented there. Identify key trends and easily spot critical moments for your target brand and their competitors.

Conversation volume is a great starting point to get a feel for your competitive environment. Here we see that Tesco consistently receives the most customer feedback. With the exception if April 2021, when mentions of Aldi spiked. Further investigation will reveal that this correlates to a critical moment for Aldi. In April 2021, they faced legal action from M&S over their Cuthbert the Caterpillar Cake.

Brand recommendation

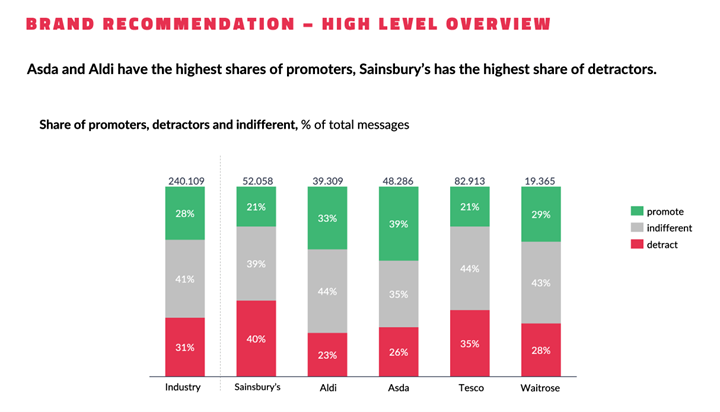

Our advanced natural language processing (NLP) AI measures the perceived influence of a post on others. In other words, is the customer recommending the brand to others? Customer recommendations are a highly valuable metric as they are a key indicator of brand loyalty, and word-of-mouth advocacy has been shown to correlate with company growth.

According to a U.K. study by Fred Reichheld, a 7% increase in word-of-mouth advocacy unlocks 1% additional company growth. The research also indicated that “a 12% increase in brand advocacy, on average, generates a 2x increase in revenue growth rate plus boosts market share” and, conversely, “a 2% reduction in negative word-of-mouth boosts sales growth by 1%.”

As you can see from the example below, Sainsbury’s has not only the lowest net sentiment score, but also the highest share of detractors. Although Aldi is the brand with the highest net sentiment score, most of their customers are indifferent.

Brand connections

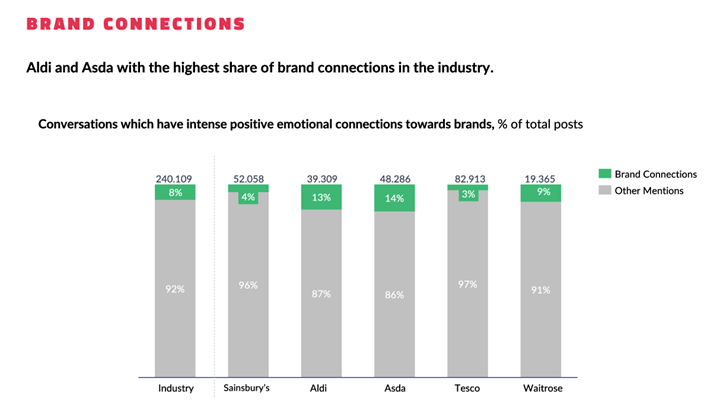

Online conversations with the strongest intensity of positive emotional language indicate that the author has developed a strong brand connection.

Building a strong connection with your customer base strengthens loyalty and directly impacts consumer spending . When customers feel connected to a brand, the majority of them (57%) increase their spending and over three-quarters (76%) will choose to buy from that brand over a competitor. It’s a valuable metric to track.

Looking at our UK supermarket report, once again, Sainsbury’s, our poorest performer when it comes to net sentiment, scores poorly on the brand connection metric. Whereas, despite Asda had a negative net sentiment, it hits record share of brand connections in the industry. This suggests that while a smaller proportion of customers are talking positively about the brand, they have developed a strong emotional connection to it.

This is another illustration of how net sentiment alone doesn’t tell the full story about a brand’s performance.

Emotion Analysis

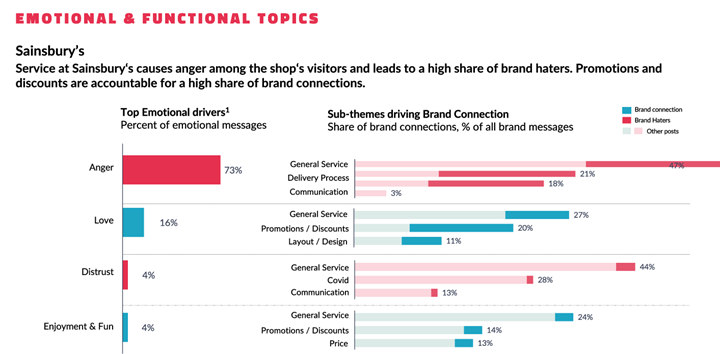

The better people feel about a brand, the more likely customers are to turn into brand advocates and devoted followers on social networks. By conducting an emotion analysis, you can understand consumers’ emotional experience toward products or brands and detect critical aspects of the customer journey.

From this slide we can see that the topic generating the most positive emotions is promotions and discounts, while service generates the most anger.

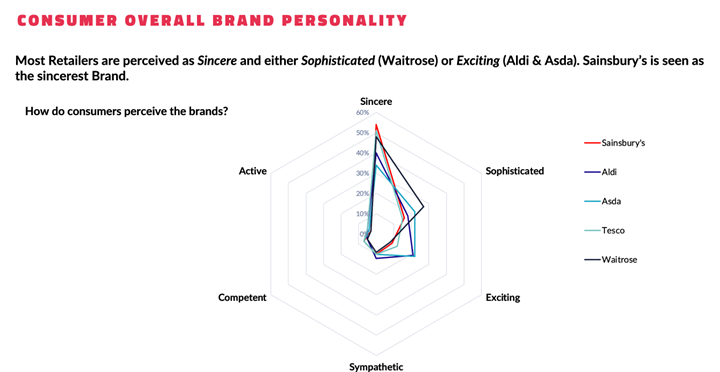

Brand Personality

Creating a clear and consistent brand personality helps customers to connect with a brand on an emotional level, which in turn drives loyalty and advocacy. It also makes it easier for customers to remember a brand and its products, which is essential in a crowded marketplace.

Using this graph, you can clearly see how customers’ perceptions of brand personality (as expressed in online conversations) compare between different UK supermarkets.

Sainsbury’s and Tesco share many of the same perceived qualities and mostly sincere, while Waitrose is an outlier with a higher percentage of conversations perceiving them as sophisticated.

In Summary

The sentiment of online conversations is just one part of the story when it comes to understanding how customers feel about your brand. To get a full picture, you need to look at a range of other factors such as customer recommendations, emotional intensity, and perceived brand personality.

The due diligence with brand health report not only gives you deep insights into customer sentiment, but it also provides valuable data on a range of other key indicators. This report can help you to understand how customers feel about a brand, where improvements need to be made, and where they’re performing well.

Check out and download our reports for more details.

Get Started With Symanto

Here are a few reasons why, overall, our due diligence with brand health report is the best in the market:

- Quick. We deliver full comprehensive reports in less than a week.

- Highly granular. Go far beyond sentiment and decode brand health.

- Wide range of data sources. Access more than 70 data sources worldwide.

- Broad industry and language coverage. We’ve worked with brands and consultancies worldwide with our technology, available in over 50 languages, and have trained a wide range of industry models.

- Emotion, psychographics & diversified brand metrics. We’ve developed text analytics algorithms that identify emotions, psychographics and brand loyalty, consumer recommendation and perception for a multi-faceted approach to understanding brand health.

To get started with your own due diligence with brand health report, and gain a comprehensive understanding of consumer perception, get in touch today.